2021 COVID-19 Supplemental Paid Sick Leave

Effective March 29, 2021, employers with 26 or more employees are required to provide up to 80 hours of COVID-19 related sick leave from January 1, 2021 through September 30, 2021.

What Does COVID-19 Supplemental Paid Sick Leave (SPSL) Provide?

Two weeks of paid leave, up to $511/day. This is in addition to California Paid Sick Days AND any sick leave that was provided under previous laws which expired on December 31, 2020.

When Can SPSL Be Used?

An employee can request SPSL (via oral or written request) if they are unable to work or telework because:

- They are experiencing symptoms of COVID-19 and seeking a medical diagnosis.

- They have been advised by a healthcare provider to quarantine due to COVID-19.

- They are subject to a quarantine or isolation order from the California Department of Public Health (CDPH), the federal Centers for Disease Control and Prevention (CDC), or a local health officer with jurisdiction over the workplace.

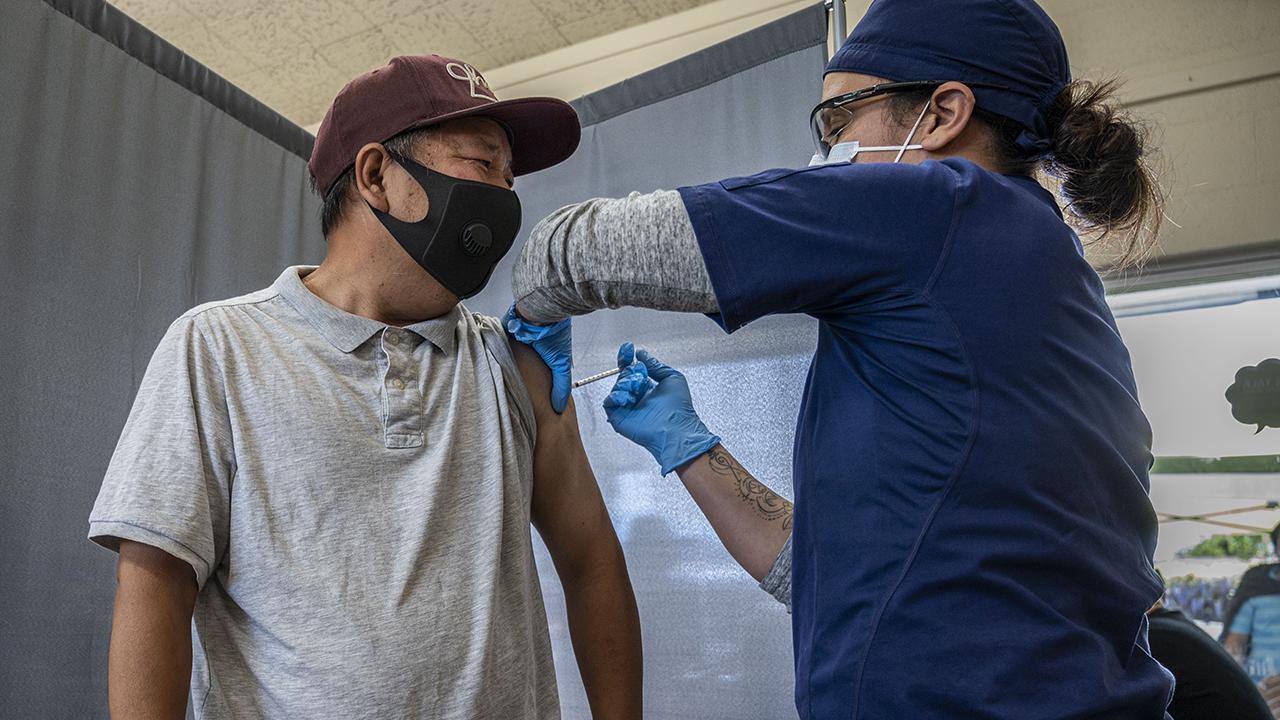

- They are attending a vaccine appointment.

- They are experiencing vaccine-related side effects.

- They are caring for a family member who has either been advised by a healthcare provider to quarantine due to COVID-19 or is subject to a quarantine or isolation order from CDPH, CDC, or a local health officer.

- They are caring for a child whose school or place of care is closed or unavailable due to COVID-19 on the premises.

Retroactive SPSL

If an employee took leave for the reasons above between January 1, 2021 to March 29, 2021, the employer is required to pay SPSL. After an employee makes the request for “retroactive” SPSL, the employer has until the next payday for the next full pay period to pay it.

Important Reminders

- Citizenship or immigration status do not affect eligibility for SPSL.

- An employee is entitled to take SPSL immediately upon the employee’s oral or written request.

- An employer may not deny a worker SPSL based solely on a lack of certification from a health care provider.

- Retaliation or discrimination against a covered employee requesting or using SPSL is strictly prohibited.

Assistance for Employers

Under the federal American Rescue Plan, private employers with fewer than 500 employees and state and local government employers can get refundable tax credits to cover the cost of COVID-19 paid sick leave.

Resources

- 2021 COVID-19 Supplemental Paid Sick Leave FAQs (English/Spanish)

- 2021 COVID-19 Supplemental Paid Sick Leave Workplace Poster (English/Spanish)

This article was created with support from the WCAHS COVID-19 Statewide Agriculture and Farmworker Education (SAFE) program funded by the California Labor and Workforce Development Agency (LWDA).